People Helping People

People Helping People

Blank Page Test

Serving Our Community 1

At Knoxville TVA Employees Credit Union, we believe in being part of something bigger than ourselves. Our philosophy of People Helping People, Members Helping Members goes beyond the branch as we work to support public schools, improve financial literacy, and serve our communities. We are committed to improving the lives and communities we serve.

Community Impact

Whether helping students in the classroom, collecting food and other items for those in need, or volunteering for local community events, we love serving our community!

We are so committed to serving our community that we've set a Credit Union goal for it! For fiscal year 2026, from October 1, 2025, through September 30, 2026, our community volunteer goal is a collective total of 10,000 community hours. Check our progress here, for our annual community service impact.

CREDIT UNION MEMBERSHIP

STAFF VOLUNTEERS

VOLUNTEER HOURS

COMMUNITY EVENTS

In Our Community

In everything we do, people come first. We work with organizations throughout East Tennessee to better the lives of people in our communities. We practice a culture of service by providing opportunities for our staff to volunteer at various community events.

Community Sponsorships 1

(click logo to learn more)

Second Harvest Food Bank VIP Food Drive

During Hunger Action Month, we partnered with Second Harvest Food Bank to help end hunger in East Tennessee with our VIP (Very Important Protein) Food Drive. Thanks to your support, we made a meaningful difference in our community.

How YOU Helped!

With your help, we collected 1,682 pounds of food, which is more than 1,522 combined meals for families throughout East Tennessee. We couldn't have done it without you! THANK YOU for your generous donations. Our communities shine brighter together!

Two Bikes Knoxville

Two Bikes aims to share their passion for bikes with everyone in the community, regardless of their economic status. They refurbish used bikes, host community bike rides, hold classes to help upkeep bikes, and offer internships to help forge the future careers of younger bicycle enthusiasts.

Smokies Baseball

We've teamed up with the Knoxville Smokies to bring even more family fun to our community! Find us in the Knoxville TVA Employees Credit Union 1st Base Concourse, where we cheer for the team and support fan favorites like Bobblehead Night. We always root for the home team. Go Knoxville Smokies!

Johnson City Doughboys

In 2016, we formed a partnership with what was then known as the Johnson City Cardinals, the minor league offshoot of the St. Louis Cardinals, and TVA Credit Union Ballpark became the home for the Cardinals. In 2020, Major League Baseball took ownership of the area’s team and announced the new Appalachian League, a collegiate league for high potential players. The new league provides collegiate players access to up-to-date facilities, competitive play, and a recruiting platform for professional scouts. Johnson City Cardinals changed their name to the Johnson City Doughboys – a nickname given to U.S infantrymen during World War I, and a nod to Tennessee’s "The Spirit of the American Doughboy” statue located behind the ballpark. Over the years, KTVAECU® has been actively onsite at TVA Credit Union Ballpark, participating in ballpark activities, interacting with the community, and sharing ways to help Members grow their money. We also work with TVA Credit Union Ballpark off-season, supporting local competitive baseball teams (14 and under) and other community events. The Johnson City Doughboys have an enormous presence in the local community, and we love being beside them!

Mission of Hope

It’s easy to forget there are families in our own backyard who have limited access to food, clothing, or basic hygiene items. This is the reality for many living in rural Appalachia. Since 1996, Mission of Hope has worked to provide the Appalachian region with resources and opportunities. Last year, Mission of Hope helped 17,000 children and their families. KTVAECU has always focused on people helping people, so Mission of Hope is a perfect fit! Over the past several years, as a strong partner with Mission of Hope, we have supplied resources and volunteers to help local families. During the holiday season, all branch locations are donation sites for the Blue Barrel Program. Members and Staff generously donate clothing, non-perishable food, toys, personal hygiene items, and cash. Our Members and Staff look forward to participating in Mission of Hope programs year after year.

Zoo Knoxville

Few places in East Tennessee are as popular as Zoo Knoxville. Where else can you see tigers, monkeys, and zebras? Zoo Knoxville invests in the community by adding something invaluable: education. KTVAECU® has partnered with the Zoo over the past 20 years! KTVAECU are key sponsors to Boo at the Zoo, where kids can trick-or-treat while they learn about wildlife all over the world! We also present Zoo Lights, where we give guests the chance to visit the Zoo after hours during the holiday season. In 2021, KTVAECU partnered with Zoo Knoxville to build pollinator gardens onsite. These provide pathways for local pollinators with declining populations like bees and butterflies. These displays also teach guests about the importance of these creatures and how to help their populations thrive. Helping the community also means helping the wildlife, and education is the best way to do it! We are proud to be a part of making this happen!

ETSU

East Tennessee State University was founded in 1911 under the name East Tennessee State Normal School. It opened its doors to 29 students with only two courses of study. Since then, ETSU has gone through two more name changes, added dozens of new majors, and seen nearly 15,000 students walk its halls. We are there for Welcome Week, Community Showcase, and GradFest. In 2019, we formed our relationship with ETSU, and in 2021, it was formally announced that the stage in the newly remodeled D.P. Culp Student Center had been named the Knoxville TVA Employees Credit Union Stage. The stage is a hub for ETSU students and local community artists to express themselves through music, drama, poetry, and art for fellow students, staff, and the community. We are proud to have our name on this stage to represent our dedication to the students and the arts for years to come.

Bays Mountain Park

& Planetarium

Bay’s Mountain offers visitors the opportunity to reconnect with nature and experience old-school traditions. With over 40 miles of trails, an obstacle course, and a gorgeous 44-acre lake, the more than 200,000 visitors Bays Mountain hosts each year have plenty to do. KTVAECU regularly partners with Bays Mountain to bring events like Campfire Tales, where local storytellers share one of the oldest traditions in human history. We also partner with Bays Mountain to bring Cinema Under the Stars, where families can begin a new tradition – watching movies together surrounded by the beautiful scenery. Whether it’s continuing traditions of the past or helping to create new ones, KTVAECU provides experiences to bring family and communities together.

Legacy Parks

East Tennessee is home to some of the most beautiful natural resources in the country. Countless lakes, rivers, and mountains draw in tourists and locals every day and provide refuge for local wildlife. For nearly 15 years, Legacy Parks has been working to conserve our natural resources while giving people access to nature. Since 2007, they have raised over 11 million dollars to create spaces where nature can be explored, including adaptive trails for explorers with disabilities. Legacy Parks also supports smaller projects like skate parks, dog parks, and classrooms to attract trailblazers of all walks of life and interests. KTVAECU recognizes the invaluable work Legacy Parks has done, is doing, and will do for the greater community, which is why we support their Legacy Luncheon for the Parks.

Emerald Youth

Foundation

For over 25 years, the Emerald Youth Foundation has worked with Greater Knoxville’s youth to build future leaders for the community. Emerald Youth Foundation provides Knoxville’s youth with the skills they need to become their generation’s leaders. They provide mentorship from local community leaders, sports programs, and programs to help graduating seniors discover and pursue their calling. In 2015, Emerald Academy was opened to provide quality education to local children. At KTVAECU, we understand how important investing in future leaders is, which is why we support Emerald Youth Foundation.

- View Our Other Sponsorships

• Alzheimer's Association Walk to End Alzheimer's®

• Anderson County High School Baseball

• Arby's Foundation

• Austin East Boys Soccer

• BalloonFest

• Bassmasters Tournaments

• Berean Christian Academy Golf

• Beaver Creek Floatilla

• Bigfoot Blast 5k & 10k Trail Run

• Birdies, Baby, Hope Benefit Tournament

• Brickey McCloud School

• Bristol Ballet

• B97.5 Teacher of The Month

• Career Fairs

• Carson Newman Football

• ChildHelp Tailgate Surf & Turf

• Claxton Golf Classic

• Copper Ridge School

• Credit Union for Kids Golf Tournament

• Crossroads Church of God Car Show

• Crown College Gala

• Covenant Health Knoxville Marathon

• Cup of Hope

• Dog Daze

• Dumplin Valley Concert Series

• East Roane County Ruritan Club

• East Tennessee Corvette Club

• Emerald Youth

• Farragut Bridal Show

• Farragut Fall Festival

• Farragut High School Volleyball

• Farragut Lawn Chair Series

• Farragut Lions Club Car Show• Fido Fest

• Firefighters Association

• First Responders Luncheon

• Fountain City Park Clean Up

• Fountain City School

• FreedomFest

• Gibbs Curve 13u Golf & 6u T-ball

• Gibbs High School Baseball, Golf, & Softball

• Gibbs MAC Football

• Grainger County Tomato Festival

• Habitat for Humanity

• Halls High School Boys Basketball, Football, Golf, Softball, & Wrestling

• Halls High School Football Feed the Team & Golf Tournament

• Halls Senior Center Drive-Thru

• Harriman Fire Pup

• Harriman Middle School

• Harriman Parade

• Harriman Parks & Rec

• Harriman Police Department

• Harriman Public Library

• Hope for Kids Christmas

• IJAMS River Rescue

• Inskip Angel Tree

• JDRF One Walk

• Jefferson County Soil Conservation

• Johnson University Welcome Fair

• Karns High School Baseball

• Kingston Century Club

• Kingston Elementary School PTO

• Kingston Parade

• Kingston Parks & Rec

• Kingston Spring Festival

• Knoxville Children's Theater

• Knoxville Fuzion Softball• Knoxville Home and Garden Show

• Knoxville Icebear's

• KCSO Mud Volleyball Tournament

• Lenoir City Arts and Crafts Festival

• Lenoir City High School Football

• Lenoir City Parade

• Lenoir City Schools

• Light the Park

• Loudon County Education Foundation

• Loudon County High School Baseball

• Loudon County Schools

• Loudon Parade

• Loudon Public Library

• Mardi Growl

• Michael Dunn Center

• Midway High School Basketball

• Mobile Meals

• Morning Point Family Fun Night

• Morristown Parks and Rec

• Morristown Rose Center

• Morristown Strawberry Festival

• Movies at McGill

• My Amazing Life

• News Sentinel Auto Show

• Night to Shine

• Nurses Night Out

• PancakeFest

• Pellissippi State Swing Big for Students Golf Tournament

• Powell Easter Egg Hunt

• Powell Elementary

• Powell High School 5K Run

• Powell High School Lady Panthers & Soccer

• Powell High Station Petting Zoo

• Powell Station Celebration• Premier Athletics

• Project Grad Lenoir City

• Puppapalooza

• Race for the Summit

• Random Acts of Flowers

• RiverFest

• Roane County High School Robotics Club & Volleyball

• Rockwood Parade

• Second Harvest

• Smokin' the Water

• Smoky Mountain Children's Home

• Smoky Mountain Service Dogs

• Sounds of Summer

• STAR (Shangri la Therapeutic Academy of Riding)

• Summer on Broadway

• Sweets for the Sweet

• Taste of Loudon

• Taste of Turkey Creek

• Tazwell Speedway

• Teacher Depot

• Teacher In-service Days

• Teacher's Night Out

• Team Seth Walk

• Tennessee College of Applied Technology - Harriman & Lenoir City

• Tour de Blount

• Travis Wagner Car Show

• Tunnel to Tower 5K

• TVARA

• United Way

• University of Tennessee Baseball & Basketball

• UUNIK Academy

• Veterans Outreach

• VOLAPALOOZA

• West Town Mall Events

• White Family Golf

• WIVK Christmas Parade

• 98.5 WTFM Teacher of The Month

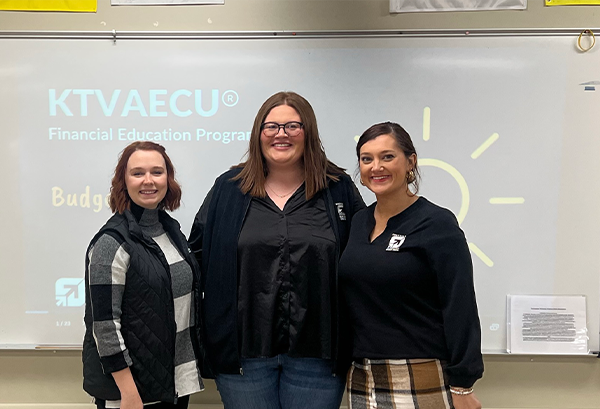

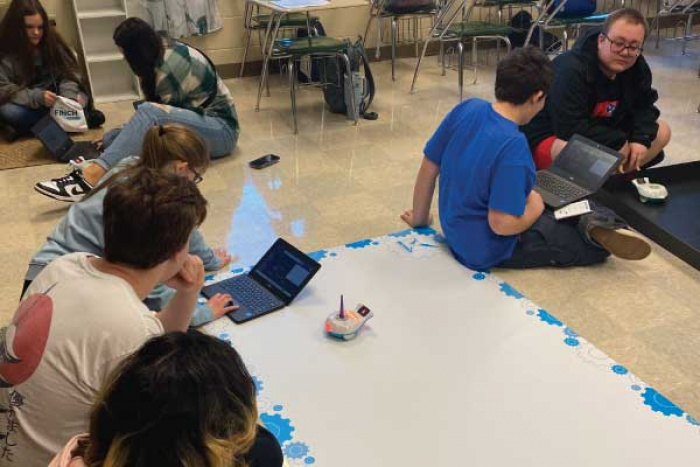

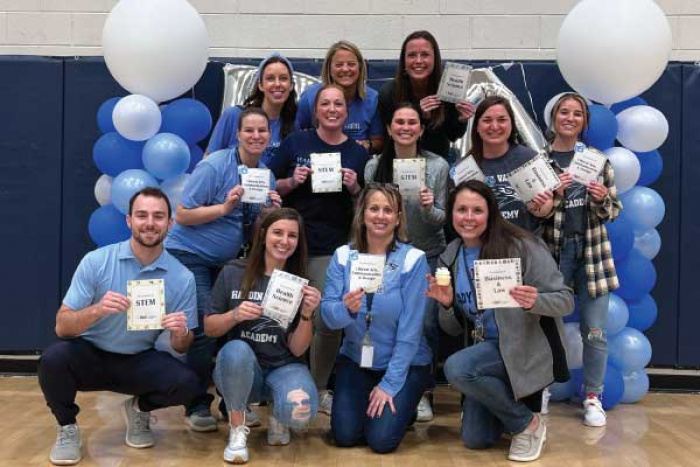

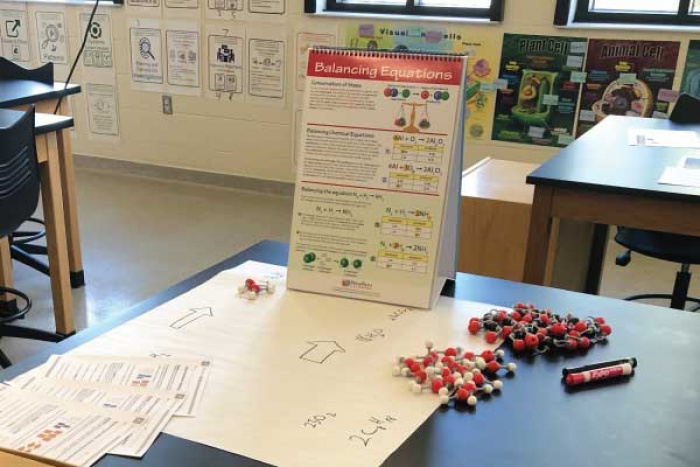

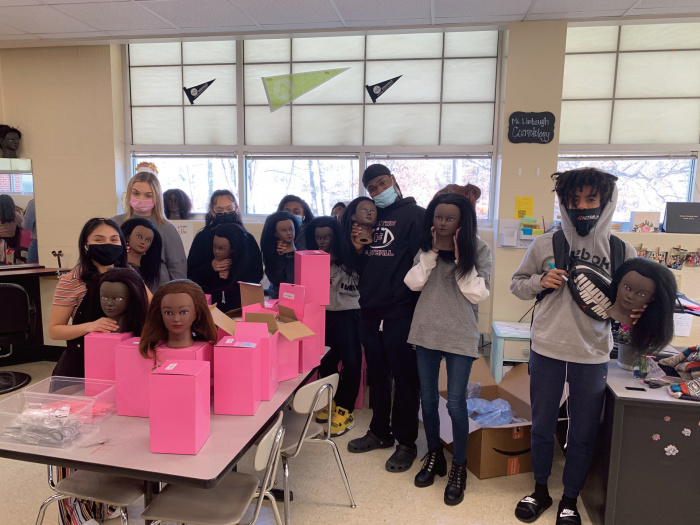

In Our Schools

In partnering with our communities, we are deeply connected to our schools and educators across East Tennessee. Whether we are teaching financial education in the classroom, cheering on our local teams, or on the field with students, we are dedicated to giving back to the children in our neighborhoods.

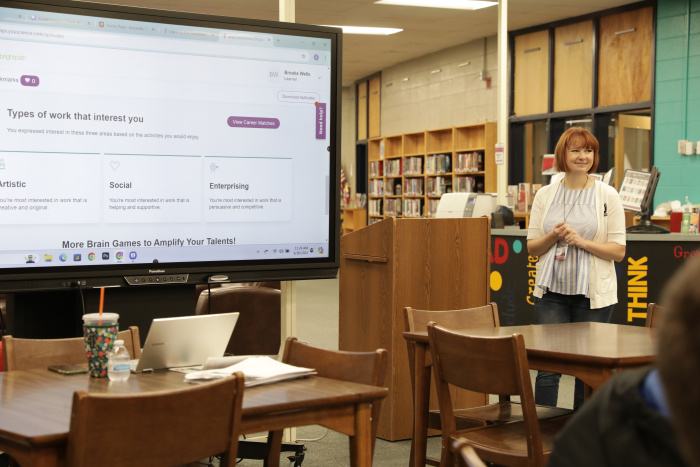

FINANCIAL EDUCATION

We teach children money management and skills that support their financial education at every age.

TEAM SPONSORSHIPS

You can see us cheering on the local athletes at all types of sporting events in our communities.

SPECIAL OLYMPICS

We love supporting our children both in the classroom and on the field as well!

Simply Smart Foundation

Project grants are offered by Knoxville TVA Employees Credit Union Simply Smart Foundation for Education to assist educators with classroom needs and projects. Grants are available to each public high school in the following counties: Blount, Hamblen, Jefferson, Knox, Loudon, Roane, Sevier, Sullivan, and Johnson City.

Build Financial Confidence

At KTVAECU®, we're passionate about financial education! Our mission is to help you grow financially. We accomplish this through FREE financial education workshops tailored to help you meet your financial needs and goals, from the basics of money management to how to navigate loans and debt.

Upcoming Events

2

View key Member Messages and Press Releases