- Account Management

- Business Services

All Credit Union locations will be closed Monday, February 16, in observance of Presidents' Day.

Online Banking

Digital Access To Your Accounts

Online Banking

Your Account is Just a Click Away

Online Banking

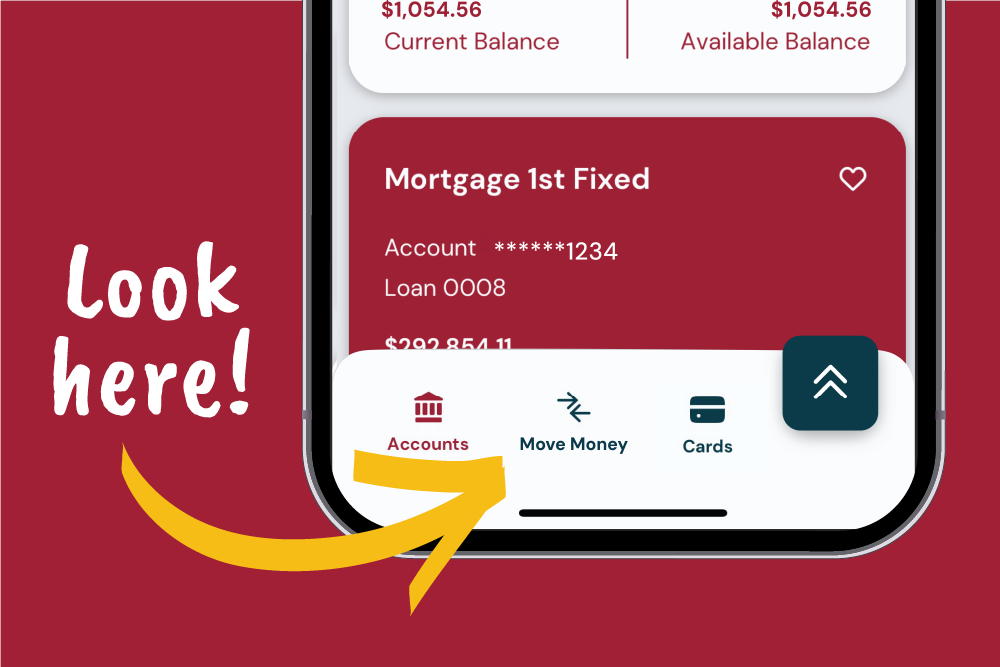

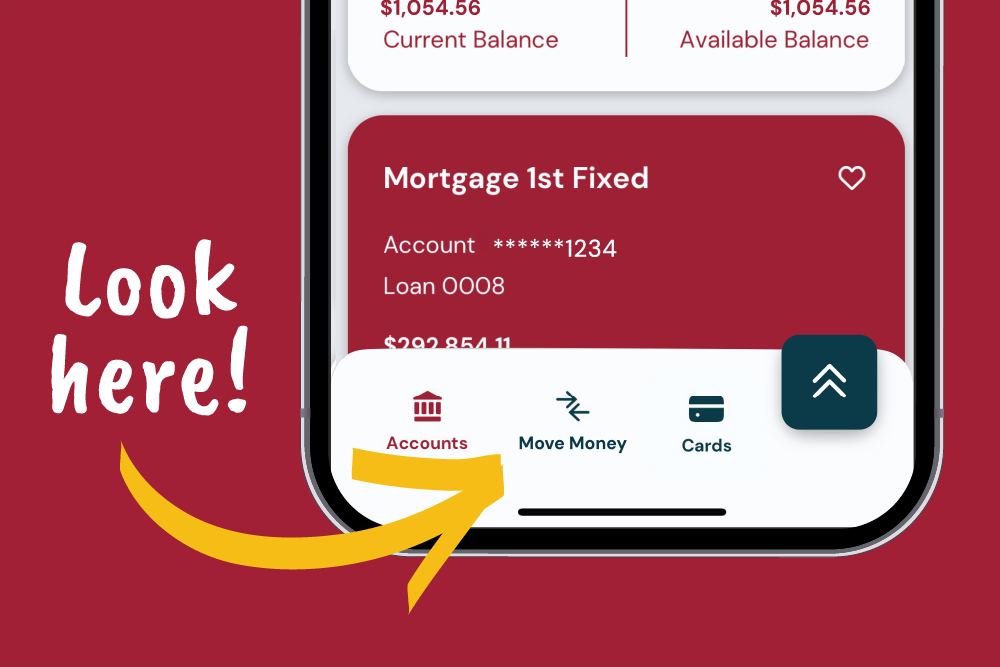

Quick Tips to Navigate Digital Banking

Pay Loan from an

External Account

1

TIP: To pay a loan from another financial institution, choose Move Money in the navigation menu, NOT the Make-A-Payment button on your Accounts page! Watch the tutorial.

Transfer to Another

KTVAECU Member

TIP: Under Move Money, choose Make-A-Transfer, then Transfer Money to Another KTVAECU Member.

TIP: When adding a New Member Destination, select the checkbox to save for future transfers.

Control My Card

by KTVAECU®

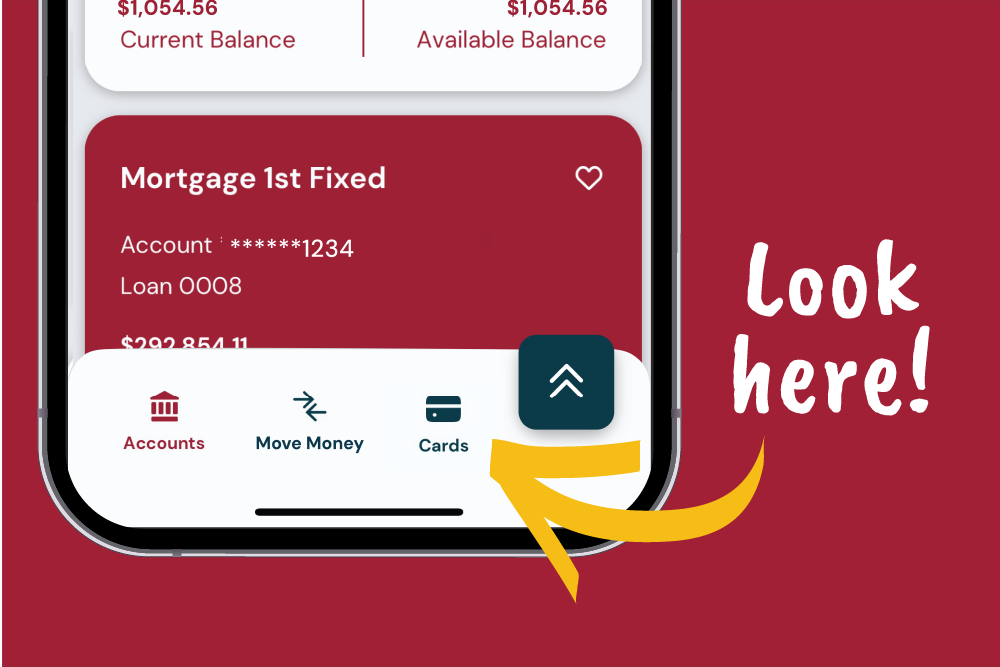

TIP: Select Cards from the bottom menu to manage all KTVAECU cards.

TIP: Remember to select Trust Device on the Account Verification screen!

Show or Hide

Your Accounts

TIP: To choose which accounts you want to see, choose the circle with your initials -> Customization -> Account Visibility.

TIP: Uncheck the Show checkbox next to accounts you want to hide!

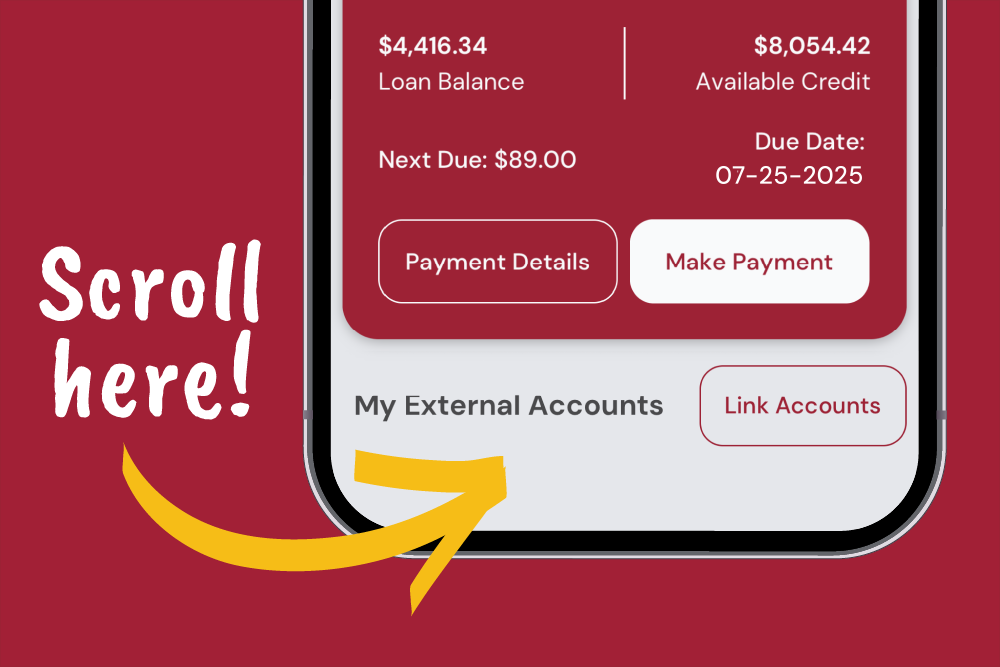

Link External Accounts

with Plaid

2

TIP: To connect external accounts, scroll down to My External Accounts and choose Link Accounts.

TIP: Connecting external accounts ONLY allows you to view those accounts inside KTVAECU digital banking. Watch the tutorial.

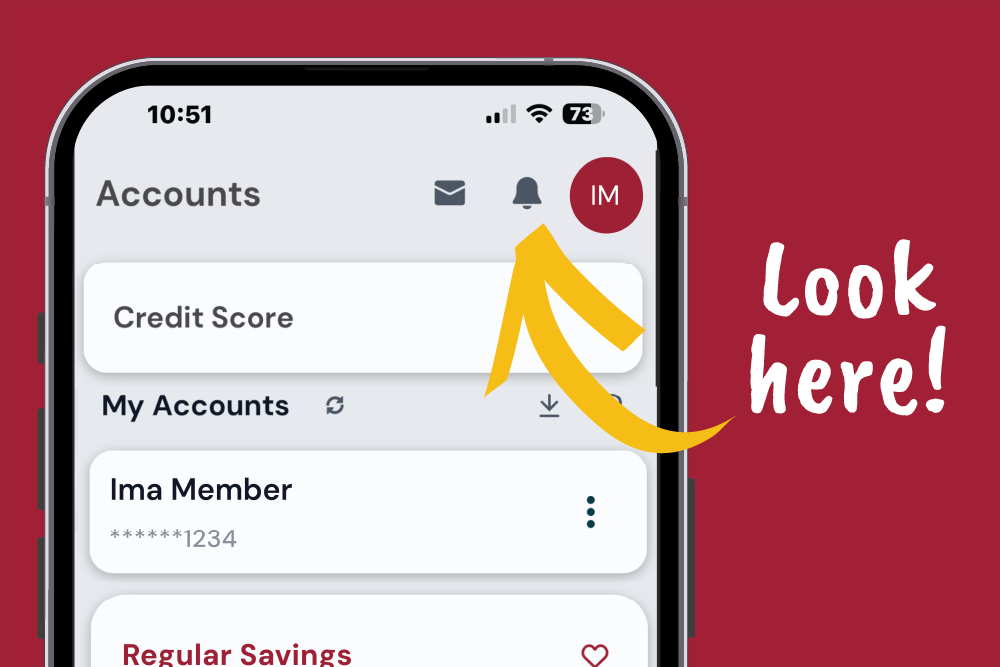

Set Account Alerts 3

TIP: Look for the bell icon at the top of your screen to set customizable, real-time alerts.

TIP: Choose the All Trusted Devices check box to get push notifications to your device!

Enroll in eStatements 4

TIP: To enroll in eStatements, select Statements from the navigation menu, then Manage Preferences to toggle the Go Paperless option.

TIP: Remember to enable eStatements for ALL accounts you want to enroll!

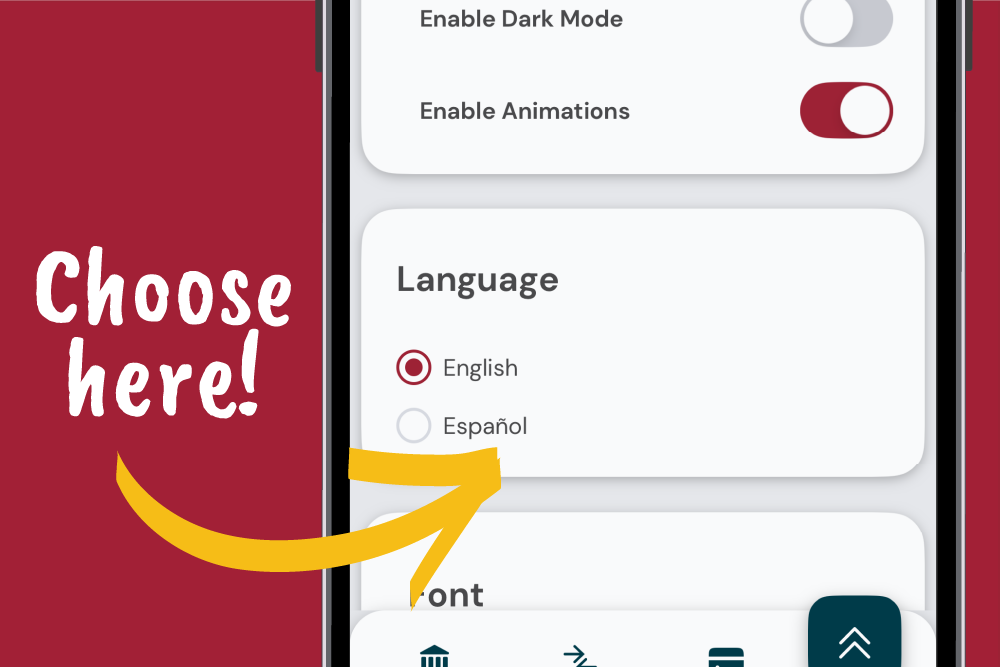

Change Language

TIP: Choose the circle with your initials, then Settings to find language options.

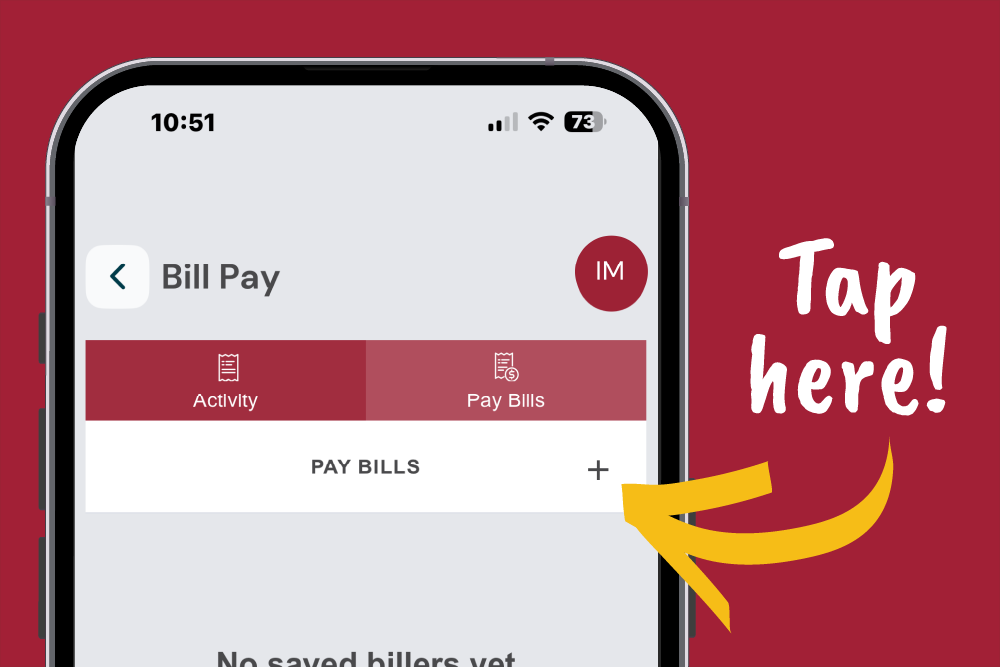

Set Up Bill Pay 5

TIP: To find Bill Pay, first select Move Money in the navigation menu!

TIP: To add a new biller, press Pay Bills +.

TIP: Only the primary account owner will automatically see previously paid billers. Joint owners can manually add billers with Pay Bills +. Watch the tutorial.

Online Banking Tools in One Place

When you log in to Online Banking, you’ll see all accounts on which you're a primary or joint owner in one convenient place. With individual username and password login credentials, access to your online accounts are even more personalized and secure.

Account Balances

Get real-time account balances and view your eStatements anytime.

Make Payments

Pay your KTVAECU® Loan or Credit Card in just a few clicks.

Direct Deposit

Set up direct deposit to get paid up to two days earlier.

Online Chat

Chat with us directly through secure Online Chat.

Open Accounts

Open a new share or apply for a loan or credit card! Get started.

Personalized Banking

Nickname accounts, pin your favorite shares, change your language, and more! Learn how.

Connect With Plaid™*

Link your external accounts to KTVAECU to manage all your accounts in one place with Plaid!

- Click Link Accounts.

- Enter your phone number to get a security token.

- Choose your institution and log in to link your account.

Control My Card by KTVAECU® 8

Fight fraudsters when you upgrade your card security with Control My Card by KTVAECU! Keep your money even more secure with card controls, real-time card alerts, and more. Look for Cards in online banking or mobile app menu to get started.

- Know which businesses have your card information saved and review your recurring payments

- Check your uChoose Rewards Points balance and redeem for gift cards, travel points, and more

- Make sure your cards still work while you travel! Set travel plans with just a few easy steps

- Securely show your card number, expiration date, and security code for up to 99 seconds

- Update your PIN anytime

Account Alerts 3

Stay in the know about account activity with real-time Account Alerts! Choose which alerts you want to track and how you want to receive them.

Choose to receive Account Alerts by text or email notification. Get alerts for what matters most:

- Your account balance is under a certain amount.

- Your credit card balance is over a certain amount.

- A deposit has posted to your account.

- Your loan payment is due or past due.

- A payment has posted to your account.

- A withdrawal has posted to your account.

- And more!

Free Credit Score

Access your credit score, set goals, and track progress for FREE, right inside Online Banking.

- Check your credit score anytime

- See tips to improve your score

- Know what's affecting it

- Get notified any time your score changes

Tools to Keep You More Secure

Your account security is our priority! We offer tools to make it easier than ever to protect your accounts.

- Control My Card: Turn your card on or off, set alerts, and more.

- Multi-Factor Authentication: Secure your login attempts with a security token via text or email.

- Card Fraud Text Alerts 3 : Get real-time text notifications about activity on your cards.

- 24/7 Member Help: Need help? We're here for you! Call Card Support anytime at (865) 544-5400.

Send Money with Pay-A-Person 6

Transfer cash to friends and family with Pay-A-Person! It’s quick and easy, and your recipient doesn’t even have to be a KTVAECU Member.

To get started with Pay-A-Person:

1. Click Move Money in the navigation menu

2. Choose To Another Person

3. Add a New Contact

4. Select the funding account

5. Enter the amount you want to send

6. Click Submit

While we take steps to keep your accounts safe while you send money, there are ways for you to help protect yourself against fraud!

Safety Tip #1

Because transfers with cash apps are considered cash transactions, it's best to transfer to people you know, like friends or family. There are no dispute rights for cash transactions.

Safety Tip #2

Never pay someone you don't trust for something promised to you in the future, like a deposit for a cruise or hotel. Money is sent instantly through cash apps and usually can't be canceled. It's best to use another form of payment to purchase a product or service.

Safety Tip #3

Don't share personal information like your PIN or login credentials with anyone. Fraudsters are always trying to gain access to your personal information. If you're not sure, just delete the email, text message, or hang up the phone and call the business directly. A legitimate company will be glad you're taking steps to keep your information secure!

Skip-A-Payment 9

Need some extra cash this month? Skip-A-Payment can help! Your account must be in good standing with at least three payments made on your loan.

Request Skip-A-Payment:

- Click Move Money in the navigation menu.

- Choose Skip Payment.

- Select your loan.

- Choose an account to charge the $35.00 fee.

- Accept the Terms & Conditions and press Submit!

Reorder Checks

Never run out of checks again! If you've ordered checks for your account before, reorder them anytime with online banking.

- Click More Services in the left navigation menu.

- Choose Reorder Checks.

- Select an account.

- If you've ordered checks before, your information will prefill. Just press Continue to place your order!

Frequently Asked Questions

- How do I register for online banking?

Click Login at the top of your screen, then select Register. You'll need your card or account number, your birthday, and the last four digits of your Social Security number to verify your account.

- How do I update my information in online banking?

Once logged in, click the white circle with your initials in the upper right-hand corner and select Settings. Make changes to your email, phone number, or address.

- How do I change my accessibility settings?

Click the gear icon in the upper right-hand corner of the login screen to toggle dark theme, change your language, or disable animations. To access even more accessibility settings, log in, click the white circle with your initials in the upper right-hand corner, then choose Settings. Find accessibility settings under Customization.

- How do I view my eStatements?

Click Statements in the left navigation menu inside online banking. Select Manage Preferences to enroll in eStatements if you haven't already. Choose View Statements to view or download your statements. You’ll need a browser capable of displaying a PDF document. Most modern browsers have this. If yours doesn’t, you’ll need a plug-in like Acrobat Reader to help your browser display PDFs.

- Does it matter what browser I use to log into online banking?

We recommend using the latest version of any modern browser, such as Chrome, Firefox, Safari, or Edge.

- What if I want more help navigating online banking?

Visit the KTVAECU YouTube channel for more video tutorials. If you have questions, call us or use the Secure Chat to get in touch!

*Plaid is a trademark of Plaid, Inc. You authorize and direct KTVAECU to share information about yourself, your KTVAECU relationship and your accounts at KTVAECU with Plaid Inc. (a “third party”) and, with any apps and websites (“third parties”) with which you've consented to allow Plaid to share your information. It is the Member's responsibility to ensure the privacy and security of your information is appropriately protected by Plaid or other third parties with whom you share your information. Use of your information by Plaid or a specific app/site, service, quality, performance, and accuracy are governed by your agreement with Plaid, Inc. or third parties, not by KTVAECU.