About Us

Who We Are

Our Mission: To help Members grow financially.

Our Vision: To be Members' first choice for all financial services.

Our Purpose: To help generations of Members on their financial journeys.

Our Service Attitude: People Helping People, Members Helping Members.

Our Commitment: Not for profit, but for service.

KTVAECU® Ranked Top 15 Credit Unions for Member Service

Callahan & Associates, a credit union research and consulting firm based in Washington, DC, recently released a list of credit unions that provide the most value to members. We are excited to share what our Members already experience every day: KTVAECU is ranked Top 15 Credit Unions for Member Service nationwide.

Callahan & Associates has provided credit unions with essential data for 35 years. They rank credit unions using the Return to Member (ROM) scoring system. The ROM system evaluates credit union performance in factors beyond traditional regulatory elements. It focuses on the value a credit union provides its members. These factors include Return to Savers, Return to Borrowers, and Member Participation. After their evaluation, Callahan & Associates ranked KTVAECU as 13th in the nation!

At KTVAECU, our focus has been and always will be on YOU, our Member. Our goal is to provide you with the best financial services possible. Recognition like this shows us we are moving in the right direction of “People Helping People.”

We Value You

We believe in putting people first, in lending a hand, and consider our Credit Union to be a family just as much as it is a place of business. We value being:

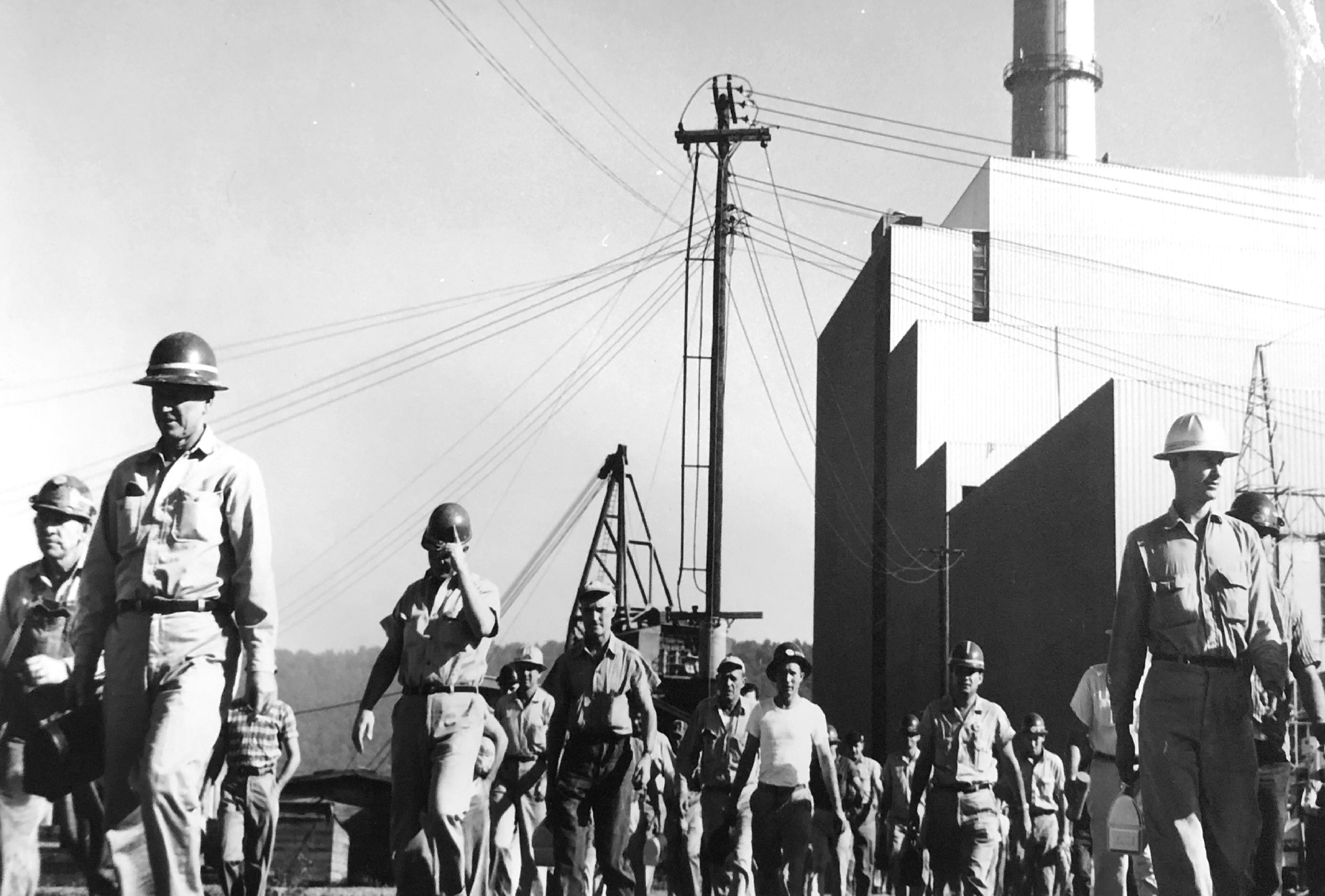

- Locally Based

We live, work, worship, and raise our families in the same communities as you. Think of us like your Mountain Lakes Community Credit Union, deeply rooted in our Appalachian values and local history. - Community Oriented

We focus on YOU and give back to OUR community because we are not-for-profit. Look for us in your area schools, supporting local teams, and volunteering at many community events. - Excellent Service Providers

When you choose the Credit Union, you're not just a number, you're family. We care about you and what's in your best financial interest, not just the bottom line.

If you haven't already, join us, join us now!